Volatility - Everybody is feeling it.

Volatility is a measure of speed and degree in which price changes; either up or down.

There is so much volatility globally considering interest rates, inflation and share markets. Some investors can be spooked in this environment with news feeds only adding to this. Here is where understanding your investment strategy and risk profile are imperative. The markets globally are in the negatives with the S&P 500 over the past year down 11.07% and the All Ords down 9.57%, it is a crystal ball question to ask when we will see the bottom of the fall. This is a testing time for risk tolerance.

All Ordinaries 1 year chart ASX XAO viewed 11 July 2022

Listed and trading companies (unlike in the GFC) are still solvent and trading, therefore for investors such as myself this is a buy opportunity of quality holdings at a discount (or on sale!). Understanding that the investment horizon is an average over 5 years, not 12 months. Industry funds will be releasing performance results for 2022 and just like the markets, portfolios will not see the previous year’s 2021 stellar ~20% results, which the market knew was not sustainable as it followed the COVID funds that left the market being re-introduced.

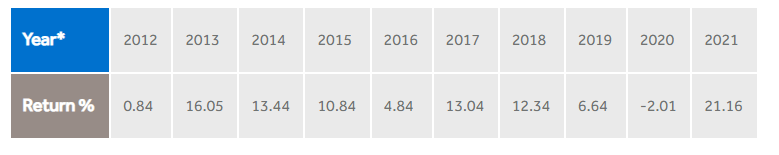

Below is an example of an industry super fund’s performance table (2022 not yet released by the fund) that highlights that not every year provides 6-7% returns, however aggregates of 5yr periods provide this for the investor. With 2016-2020 average of 6.97%, 2012-2016 9.2% or 2013-2017 11.64%. This highlights Sequencing risk, which is a whole other risk factor for another article!

Hostplus mysuper product dashboard investment return on balanced portfolio viewed 11 July 2022

Investors stay calm, review your investment strategy, confirm you hold quality investments and hold on for the ride, remember it is about the averages. Reach out to an adviser if you would like to review your investment strategy and investments.

Latest News