Upgrade your old website...Why?

It’s been some time since you built your website, now may be a good time to update it. Here are some reason’s why it’s a good idea:

1. Google’s algorithm has changed many times since we made your website live. Google rewards different things than they used to. Things that can help get your business back near the top or organic Google searches for your industry.

2.

The web is faster now - we can design with full screen images and also full screen video sections on your site to give it that wow factor.

3. Your photography and offers may well be out of date - a new site design will update your potential customers with your business and where it is today.

4. Video is now huge - most people when faced with paragraphs of text to read or a short video will choose the video. We can film and edit a video or a series of videos to help explain your products or services.

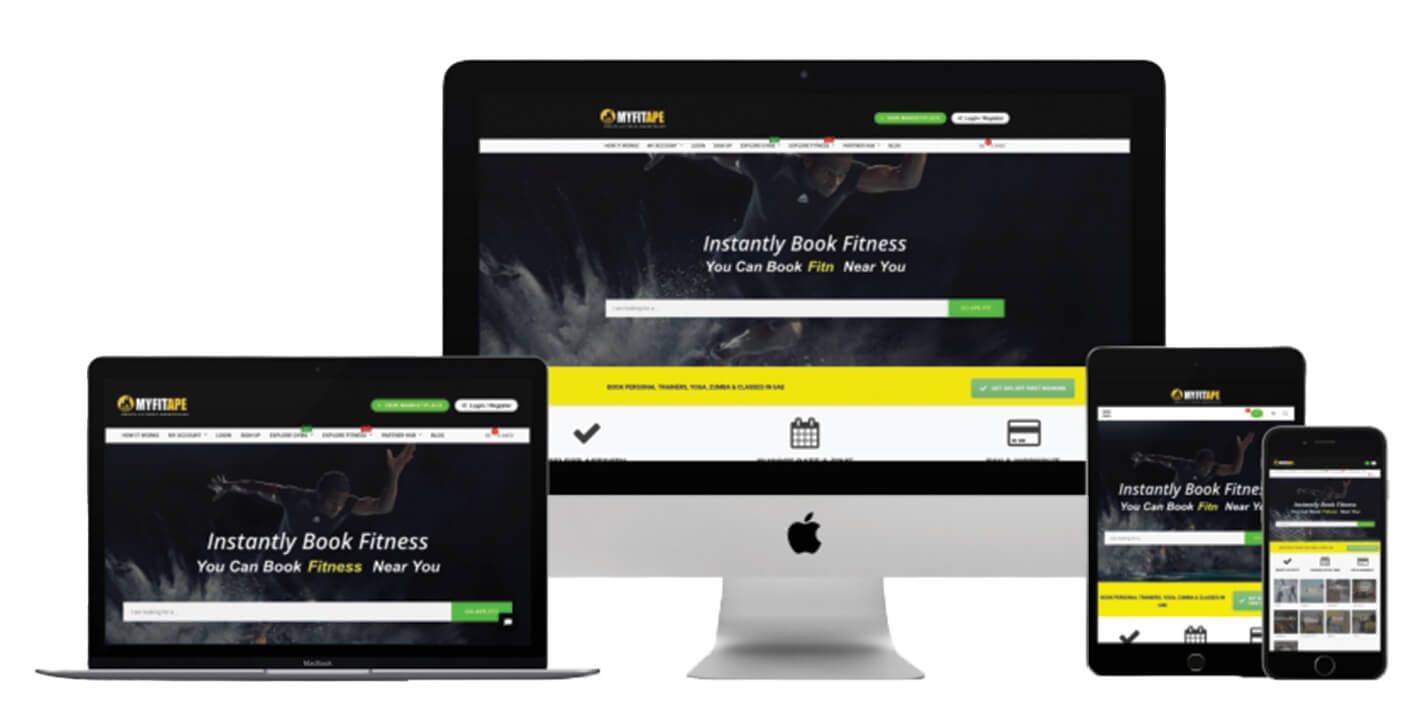

5. Your website has never been seen on so many different devices - desktop and laptop computers, tablets and smartphones. Making sure your site is optimised for all of these devices is key.

Your website is a tool within your business, from time to time it needs attention just like a builder wouldn’t expect their favourite saw to last forever without sharpening or replacement - the same goes for your business website.

Give me a call today and we can organise a time to meet up and discuss what your site could be going into the next few years of business.

Payment options:

1. No up front cost - a low monthly fee

2. 4 equal monthly payments

3. 50% at the start, 50% at completion

0448 686 560

Gavin Nash

Director of Marketing

Latest News