Monthly Performance Update - January 2020

Markets

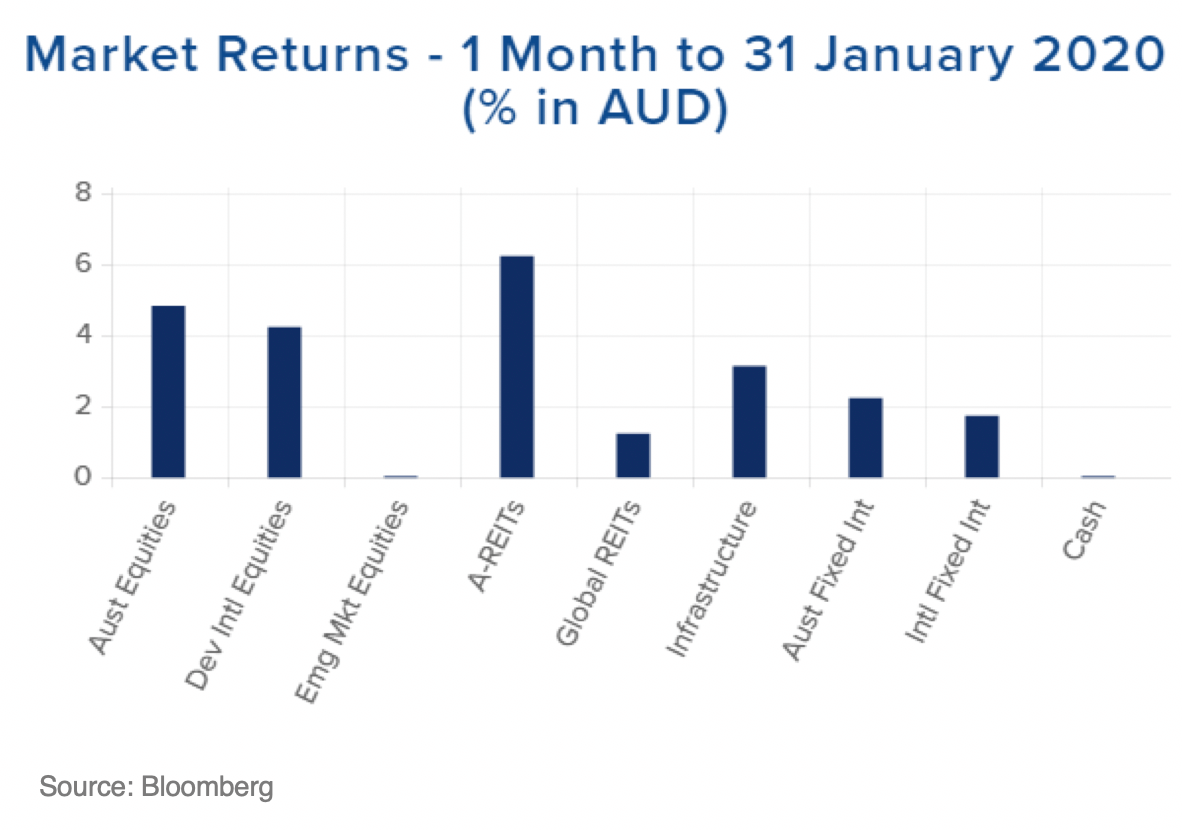

Markets fell in the last few trading sessions of the month as the coronavirus epidemic put a large dent in the liquidity fuelled rally that started the year and most equity markets gave back their gains from the first couple of weeks of the year. However, a weaker Australian Dollar meant that international equities actually appreciated by 4.3% in Australian Dollar terms. Emerging markets, of which China is the biggest constituent, remained flat.

While the Australian market also ended the month up +4.9% its relative performance was flattered by a rebound from the previous quarter’s underperformance of 6% (driven to a large extent by the banks). Similarly, Australian REITs posted a very strong return of +6.3%, having fallen by almost 10% in December. In fact, it appears that Australian banks, REITs and some individual stocks are becoming increasingly interest rate sensitive as the opposing influences of a weaker local economy and potential interest rate cuts play out in long-term interest rate markets.

In January Australian 3-year bond yields have fell for four consecutive weeks and are again nearing record lows amid growing concerns of the impact of coronavirus on the broader economy and expectations that the RBA is likely to cut interest rates again in 2020. The Australian 10-year yield also approached its record low, and the Australian dollar fell to 66.9 US cents, its lowest level in over a decade.

It was therefore really a fall in interest rate expectations, in turn due to perceived weakness in the economy, that lifted the Australian equity market. By the same token, it was an apparent improvement in global growth prospects (and the effect that had on local rates) that caused local stocks to lag in December. Australia’s recent induction to the topsy-turvy, ‘good news is bad news’ world of low interest rates may be exacerbated by our relatively high dividend yields (due to dividend imputation) and so our whole market has become a bond proxy for overseas investors as well as local retirees.

Otherwise the US appeared to be the epicentre of the risk-on sentiment that fuelled the best part of the month. A better than expected earnings season boosted the likes of the Information Technology and Utilities sectors, while Energy and Healthcare lagged.

Global REITs were up a more sedate +1.3% and infrastructure assets continued to rise, up 3.2% in January. Australian and international fixed interest returned +2.3% and +1.8% respectively, and cash returned +0.1%.

While the full-scale implications of the coronavirus are still broadly unknown, markets were quick to discount such concerns after an array of worsening data showed no real signs of the virus slowing down. An extension of the nation’s Lunar New Year holiday means that most of the economy is still effectively sealed off, however substantial selling is currently expected once local equity markets reopen. At the time of writing the PBOC announced support of 150 billion yuan ($32.4 billion AUD) to support the country’s $45 trillion financial system and the local currency.

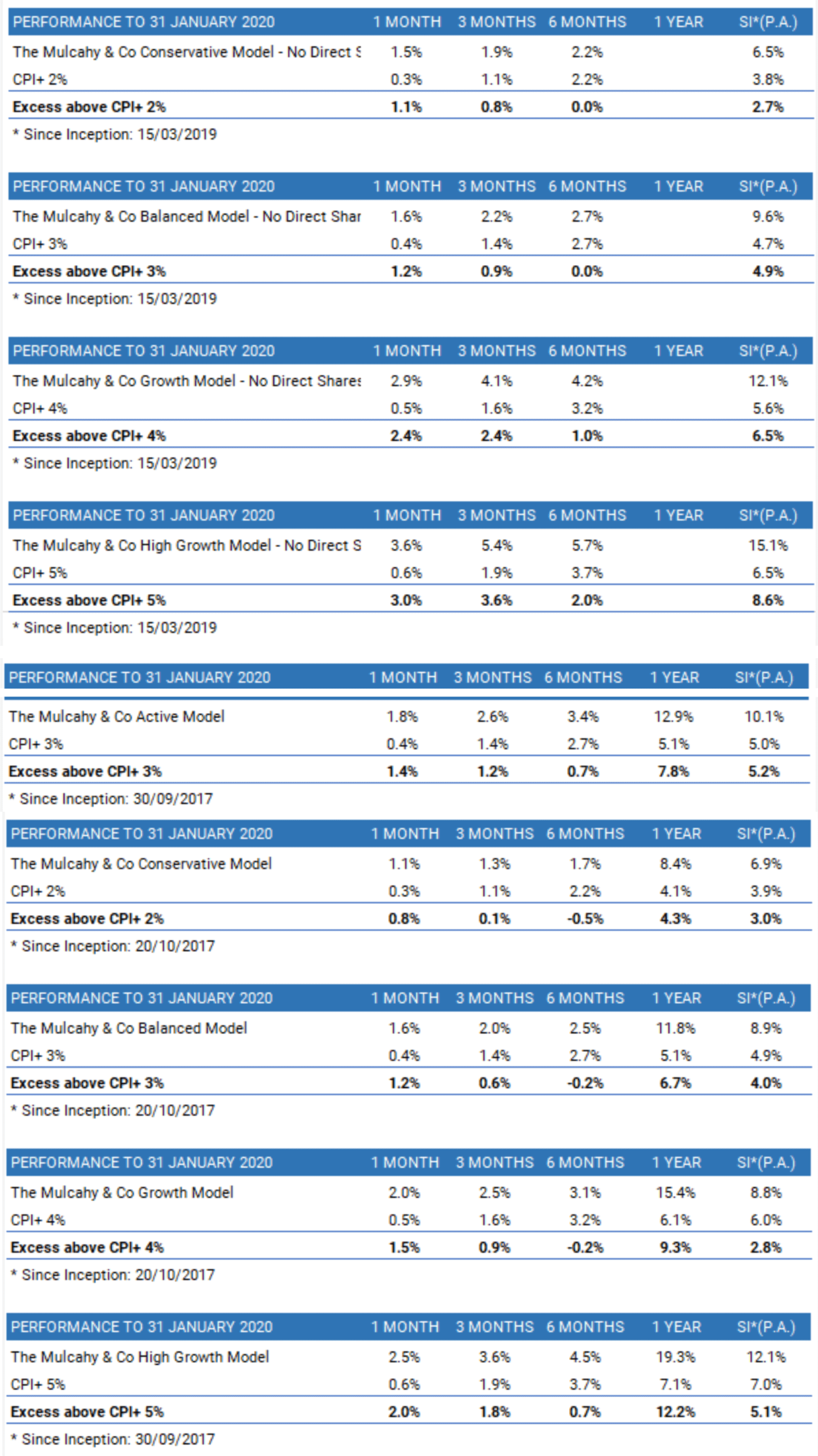

Portfolios

Asset allocation contributed positively to performance for the month. This was predominantly driven by the portfolios overweight exposure to Australian equities, which enjoyed a solid rebound led by the banks and CSL. Overweight allocations to cash detracted from performance slightly, however this has been a position that has benefited the portfolios greatly in recent months and allows us to keep some powder dry given where valuations are currently at.

Vanguard’s U.S. Total Market Shares Index ETF (VTS) was the single-highest performing security within the portfolios for the month, up +5.6%. The liquidity-fuelled US market was the epicentre of investors risk-on trade through the beginning of the year, shrugging off geopolitical tensions and growth concerns around the world. The US market only seemed to show concern of the potential implications of the coronavirus later in the month hence the impressively solid return.

Regarding the direct equity portfolios, the Australian equity component underperformed the broader market, returning +2.0% vs +4.9%. This was largely driven by the portfolio’s position in Webjet (WEB), Star Entertainment (SGR) and Treasury Wine Estates (TWE). Treasury Wine Estates fell after downgrading its earnings growth guidance from a bullish 15-20% per annum to a more modest 5-10% in 2020 and 10-15% in 2021. As we wrote in our latest portfolio update, the stock now yields over 3% and if it can manage high single digits earnings growth in the future then we feel it holds its place in the portfolio as it is cheaper than the change in earnings guidance suggests it should be. That said, it is economically sensitive and any further sign of weakness (actual declines in profit) might see us revise this view. The largest relative contributions to performance came from the portfolio’s overweight position in Link Administration (LNK), Sonic Healthcare (SHL) and Challenger (CGF) compared to the market.

Latest News